A new report from UBS discovered that 56% percent of married women leave decisions of

investments and financial matters to their husbands. Among them, 61% are millennial

women, who do this more than any other generation.

Ladies, what’s going on?

Ideally, financial planning should be gender agnostic considering both men and women

today are equally educated, independent and in most cases even equal breadwinners of a

family. But women’s aversion to active decision-making in this regard may stem from

numerous causes: lack of awareness, lower risk appetite, or lower confidence. In fact,

the same report showed that 85% of married women stay out of long-term financial

decisions because they believe their spouses know better.

This has to change. Women need to step up, take the reins of their financial future and

be equal partners in money matters. If you can launch rockets, win Olympic gold and run

major companies, there is no reason you cannot have complete control over your

money.

In fact, financial planning is not remotely new to Indian women. Our mothers and

grandmothers have been saving, investing and planning their finances for generations.

They often saved aside some money from daily household expenses, hidden for use during

an emergency. This kept them partially independent of their husbands, and demonstrated a

practical mindset.

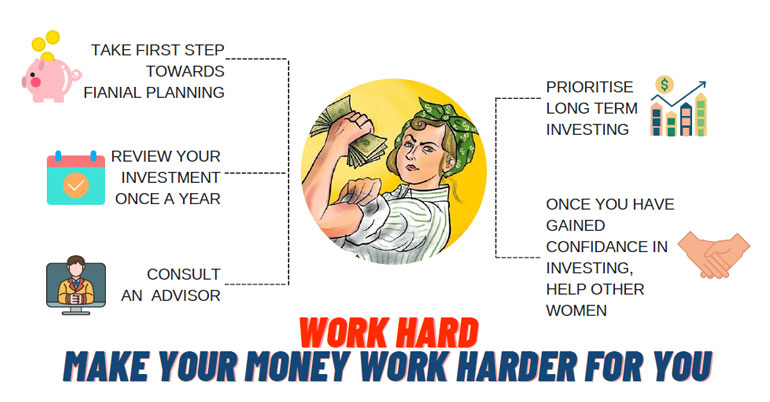

In actuality, financial planning is more than manageable if one adheres with this proven

guidelines. At Arthtosh we tell our investors that - "You work hard. Make your money

work harder for you"

Emulate an advisor you like: While you increase your financial vocabulary, you’re bound to stumble across advisors. Find the one you think resonates with your ideas and then emulate them. It’s always better to have a guide to follow than simply shooting in the dark.

Think long term: Set your financial goals by determining what you want to achieve. Say you want to own a house or start a business, you’ll need to calculate an approximate target and invest accordingly. Investing in financial products like systematic investment plans (SIP) help you get a head start as well as earn heavy returns through compounding. Depending on your risk appetite, even if you invest small 10000 per month for ten years, you will be able to build a corpus of at least ₹22.5L lakh from only ₹12 lakh investment with expected return of 12%. Think long term and invest early.

Teach other women: Once you have gained confidence in your investment skills, help other women do the same. This not only gives a boost to your confidence, but will also help your friends become financially independent. Once you have the knowledge, pass it on.

Our vision at arthtosh is to guide everyone towards their financial freedom. Because the highest form of wealth is ability to wake up every morning and say "I can do whatever I want today."

The ability to do what you want, when you want, with who you want, for as long as you want, is priceless. It is the highest dividend money pays. Those who understands plan toward it and those who not looses it.

Start small, but start. Don’t let doubt stop you from being the master of your financial fate. There are endless resources for educating yourself, both online and offline. Stay true to the aforementioned guidelines, and you will find yourself making the right calls in no time!