Introduction:

Financial planning often

seems like a daunting task, shrouded in mystery and

complexity. However, the reality is far from it. In fact,

engaging in financial planning can simplify your life, provide

clarity, and empower you to make informed decisions. Let's

debunk the myths surrounding financial planning and explore

how a financial planner can guide you towards the right

strategies, ultimately helping you gain control over bad

buying decisions.

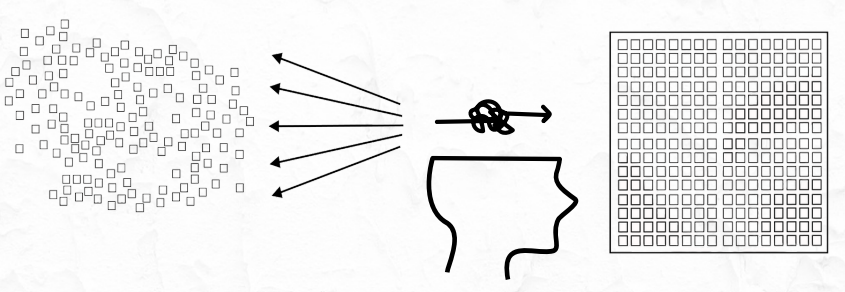

1. Myth: Financial Planning is Complicated

Many individuals shy away from

financial planning,

assuming it requires an extensive background in finance or

intricate knowledge of investment strategies. The truth is,

financial planning can be simplified and tailored to your

specific needs. A skilled financial planner acts as your

partner, breaking down complex concepts into understandable

terms and creating a roadmap customized for your goals.

2. Simplifying Life: Clarity and Peace of Mind

By engaging in financial planning, you gain a clearer

understanding of your current financial situation, future

aspirations, and the steps required to achieve them. This

newfound clarity brings peace of mind, as you no longer feel

overwhelmed by financial uncertainty. With a well-defined plan

in place, you can approach life's challenges and opportunities

with confidence, knowing that you are on the right path

towards your goals.

3. Gaining Control over Bad Buying Decisions

One of the significant benefits of financial planning is

gaining control over impulsive and unnecessary spending. A

financial planner helps you develop a budget, allocate funds

wisely, and identify areas where you may be overspending. By

examining your financial habits and aligning them with your

long-term goals, you can make conscious and informed choices,

avoiding regrettable impulse purchases and instead directing

your resources towards what truly matters.

4. The Role of a Financial Planner

A financial planner is your guide and ally in navigating the

complex financial landscape. They possess the expertise and

experience to devise strategies tailored to your unique

circumstances. Whether it's retirement planning, investment

advice, tax optimization, or risk management, a financial

planner can provide valuable insights and suggest appropriate

solutions that align with your goals and risk tolerance.

Conclusion:

Financial planning is not

as daunting as it may seem. By partnering with a financial

planner, you can simplify your life, gain clarity, and take

control of your financial future. Dispelling the myths

surrounding financial planning, we understand that it is

within reach for everyone. So, take that first step towards a

more secure and fulfilling future by embracing financial

planning and unlocking the benefits it offers. Remember, it's

never too late to start planning for a better tomorrow.

On July 20, 2023